保险

用户在使用线上投保业务时,通过人脸识别核身验证进行投保书电子签名及支付保费,为商业保险公司或社保机构提供网络投保身份验证,助力保险企业互联网+的快速发展,有效避免保险欺诈。

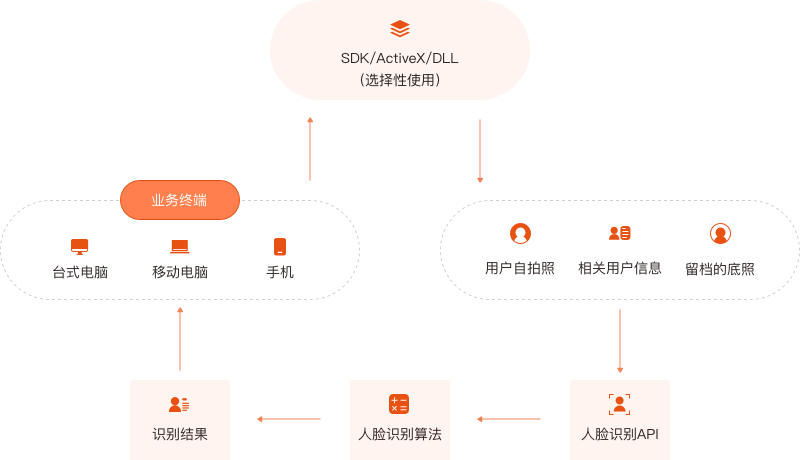

人脸核身方案通过获取待验证人的姓名与身份证号,调取可靠的用户预留图片,来检验被验证人的身份。方案以人脸识别为核心,为金融客户提供可信的鉴权服务,降低业务风险,推动“互联网+金融”等业务模式的应用与发展。

用户刷脸解锁进入桌面系统实现智慧办公。高安全防攻击策略,毫秒级刷脸开机,比对精准度十万分之一,满足多款办公笔记本,覆盖32位和64位系统。极低成本实现智能办公体验。